Before the dawn of the internet age, marketing looked a lot different. The first time a potential client heard about your company or brand was because you were already reaching out to them.

This approach was called outbound marketing, in which you had to reach out to the contact in order to begin the prospecting process. Many times this involved a phone call. And it could be argued that outbound marketing is why caller ID was invented, so that people could avoid the calls.

In today’s digital age, however, your prospects are being exposed to your brand long before they are even on your radar. They may search on Google for a keyword and see your company listed among the search results. Or, they may see your social media accounts on their feed and then click through to your website to learn more.

This inbound marketing approach has become the leading marketing strategy for both B2B and B2C companies, as most prospects no longer want to get spammed either by a cold phone call or random postcard in the mail before they even know anything about you. Those are huge turn offs.

Inbound marketing revolves around the marketing funnel. But what is a marketing funnel and why is it important for financial advisors looking to add new clients and retain existing ones? We’re here to help.

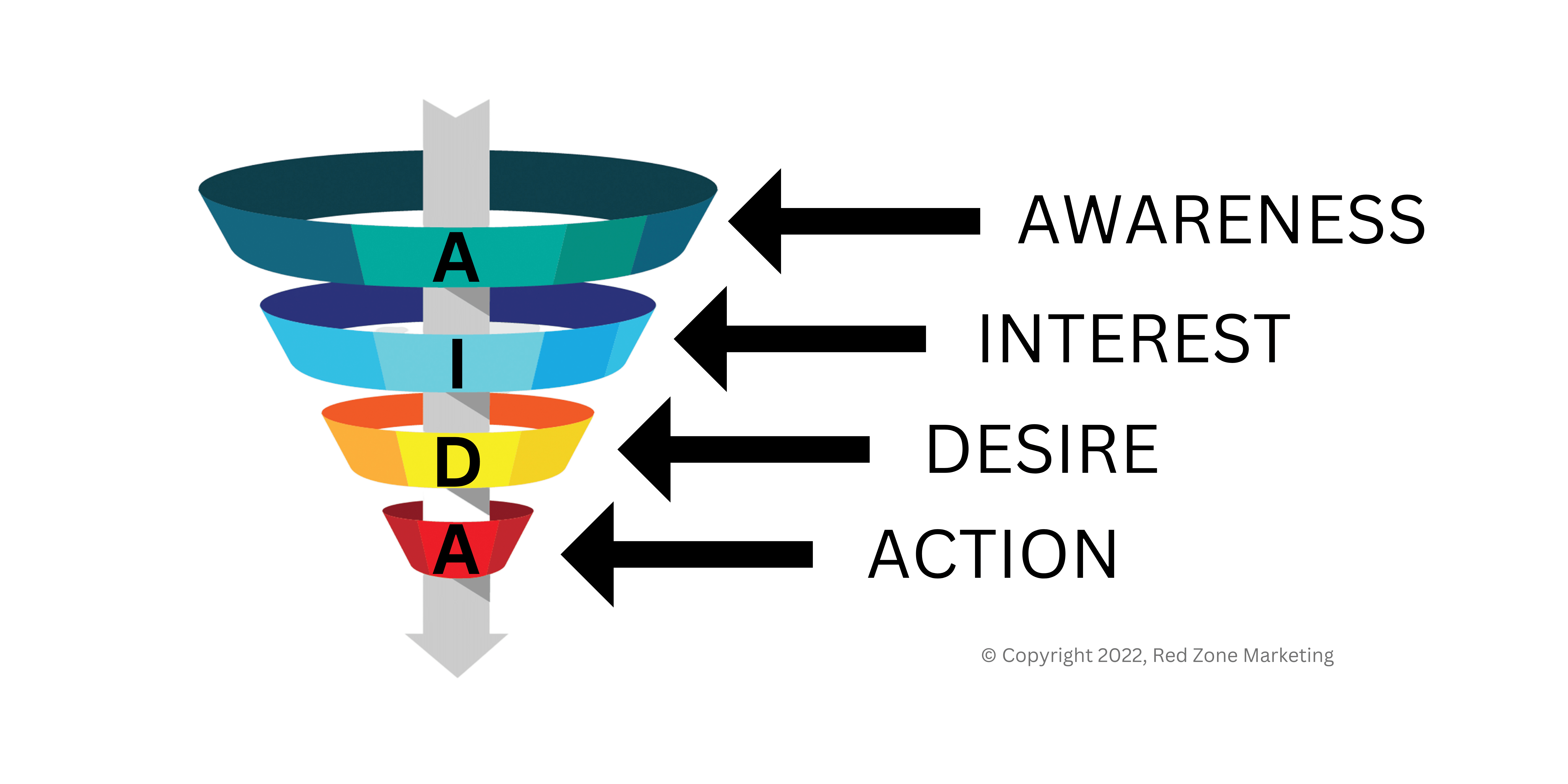

The Four Stages of the Marketing Funnel

The marketing funnel is a four-stage process of turning a prospective customer into an actual customer. The shape is a funnel because of the size of the audience at each phase. The first phase contains the most prospects, with the audience shrinking as you go further down the funnel and identify the truly interested prospects as the not-so-interested contacts fall off.

Let’s take an in-depth look at what occurs at each stage of the marketing funnel:

1) Attention Stage

Prospects enter the top of the funnel, called the Attention Stage, when they are first exposed to the brand. This means you now have their attention.

As we mentioned in the intro, a prospect — also known as a lead — enters the Attention Phase through their own actions. They may use a search engine to search terms like “financial advisors near me” or “how to get started with retirement planning”. If your website ranks high in those keywords, it will be shown to the lead on the search engine results page where they have the option to click on the link that brings them to your site.

While leads can also enter the Attention Stage through other digital mediums, such as social media, they may have also seen a billboard, bus wrap, bench advertisement, or heard about your brand from someone they know. This last batch of leads who come in through word-of-mouth are often the “hottest” leads, meaning they are more likely to convert into customers or clients. Afterall, the opinion of those we respect is treasured more.

Again, you may not know when someone has entered the Attention Stage since they have not indicated any interest yet. This is why having calls-to-action on your website directing folks to fill out a form if they are interested or offering downloading content like a guide to saving for college for kids that requires entering a name and email is key. You need to capture their contact information in order to help move them further down the funnel.

2) Interest Stage

After a lead has filled out a form or possibly even called you or emailed you, they are showing they are interested in your brand and ready to learn more about you and your business. This is often referred to as “raising a hand.”

Too often businesses get over excited when a lead shows interest and try to jump right down to pushing the sale/getting that lead to become a customer. Remember that they just heard about you. This would be like proposing marriage on the first date after your date asks if they can see you again.

Instead of scaring off a lead with a used car salesman approach, offer them more information about you and your business. This can be a simple overview of your firm and your services that is a printed or downloaded guidebook, or even better, testimonials about how you have helped other clients just like them. Read the room, so to speak, and use the least intimidating options first, such as sharing a case study, before moving on to the heavier tactics like an in-person meeting.

The goal is to continue warming them up by feeding them whatever information they need and want to know in order to consider you as the solution. Some leads may only spend a short amount of time in the Interest Stage, while others may stay here for months or years. Just continue to keep them engaged so that you and your business remain at the top of their mind.

3) Desire Stage

When a lead is ready to make a purchase, they have entered the Desire Stage. This doesn’t exactly mean they want your product or service. They are likely considering other businesses as well.

Now is the time to put on your aggressive shoes. You must sell them on why you and your services are the best option for them. Offer that free in-person consultation and show them what they can expect if they choose you. You have to continue to stand out in their minds to win their business.

Going back to our date analogy, think of the Desire Stage as proposal time. And don’t think that they won’t consider the entire “relationship” they’ve had with you so far. So, again, make sure you are making all the right moves at the right stages in order to build trust that you are the right choice. It’s that trust that will push you to the top.

4) Action Stage

Leads are no longer just prospects at the Action Stage; they are now customers. Congratulations! Your hard work has paid off. But, your work is not done.

You need to make your new customer continue to feel confident in their decision. This means making onboarding a seamless process. This means keeping the flow of communication going. Sending email newsletters to help your customers stay on top of their progress toward established financial goals and to answer their burning questions when the stock market takes a downturn will help comfort them and, hopefully, keep them excited to be your client.

And don’t forget the bonus phase: The Loyalty Stage. This is where you turn existing clients and into raving fans, or brand ambassadors. Afterall, happy customers who give out referrals without anything in return make for hotter leads and higher potential customer conversion rates.

“No-Nonsense, Money in the Bank” Marketing Funnels for Financial Advisors

Now that you know all about the marketing funnel, you can use it to keep your prospect pipeline full of more potential clients.

But just remember to go in stages. If you jump around to different phases, you may scare off a potential client. Or if you fail to engage at the right time or even at all, you will lose prospects and possibly dry up your funnel.

And that is why you should never stop working to fill your funnel. Prospects and clients may move on for reasons completely out of your control. Efforts should be consistent to move leads down the funnel and convert them into new clients.

Do you have questions about this article or about our marketing consulting services? Either leave a reply in the comment box below or contact us privately and directly, here.

Maribeth Kuzmeski, PhD, President of Red Zone Marketing, is a marketing strategist, advisor to financial services companies, bestselling author of nine books, and a professional speaker rated as a Top 25 C-Suite Speaker as seen in Meetings & Conventions Magazine. She speaks on topics including marketing, branding, sales, and customer service.